Fill Out Your Childcare Receipt Form

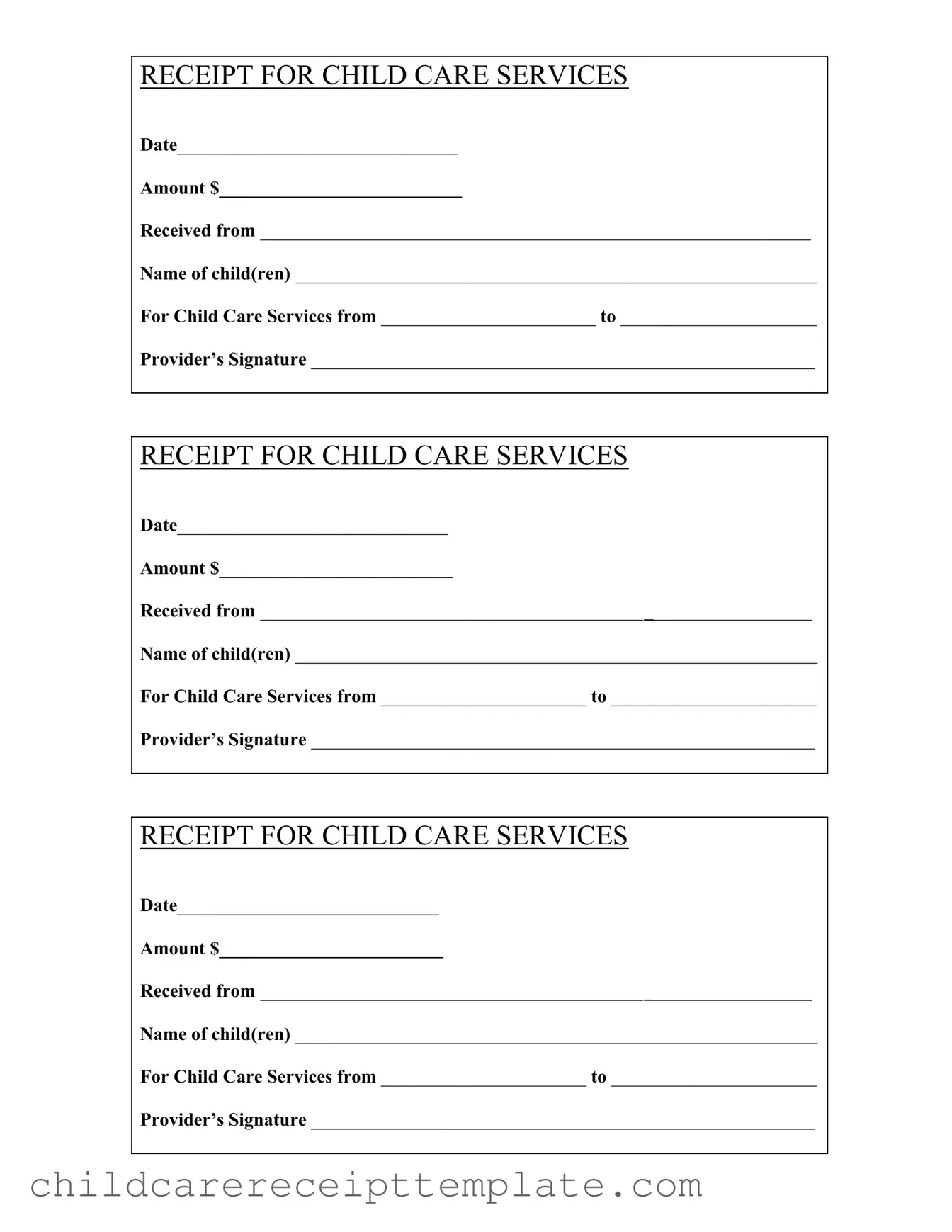

The Childcare Receipt form serves as a crucial document that records the payment for child care services rendered. This form includes essential details such as the date, amount paid, the name of the child or children, and the signature of the provider. Ensuring accurate completion of this form is vital for both parents and providers, as it can facilitate reimbursement processes and tax deductions.

To fill out the Childcare Receipt form, click the button below.

Create This Document Online